Tranalysis

HNA Holdings turned losses into profits last year and continued to make profits in the first quarter of this year.

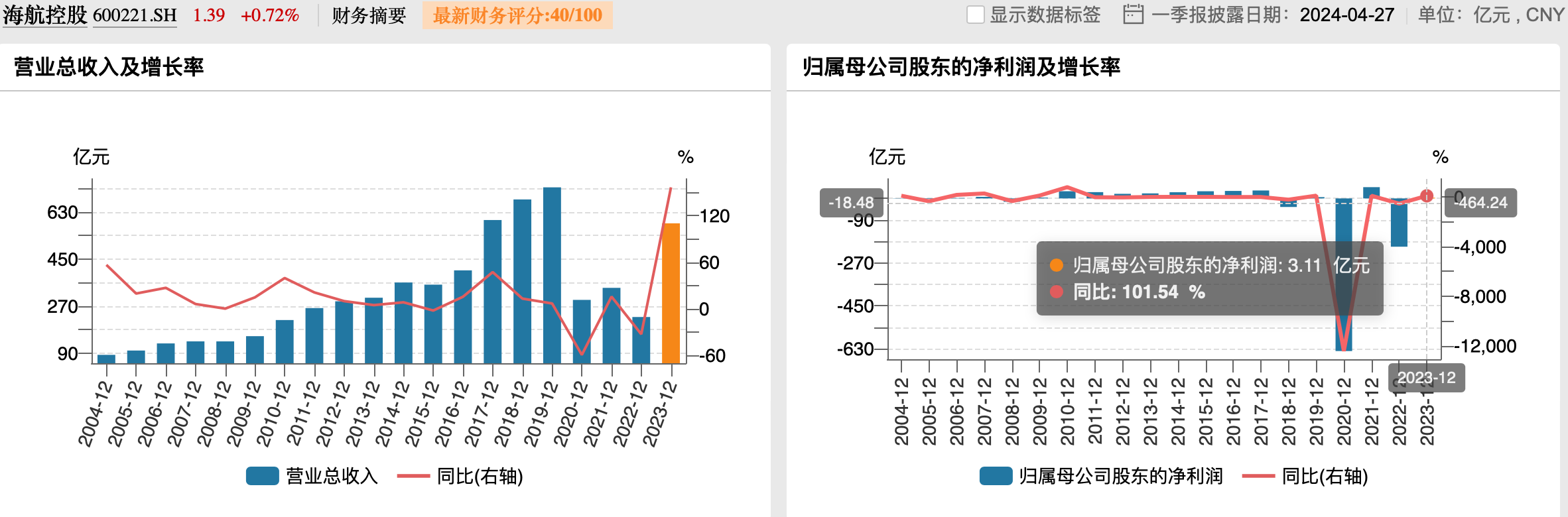

On the evening of April 26, HNA Holdings (600221. SH) released its 2023 annual report and first quarter 2024 report. Last year, HNA Holdings achieved revenue of 58.641 billion yuan, a year-on-year increase of 156.48%, and the net profit attributable to the parent company was 311 million yuan, compared with -20.247 billion yuan in the same period of the previous year.

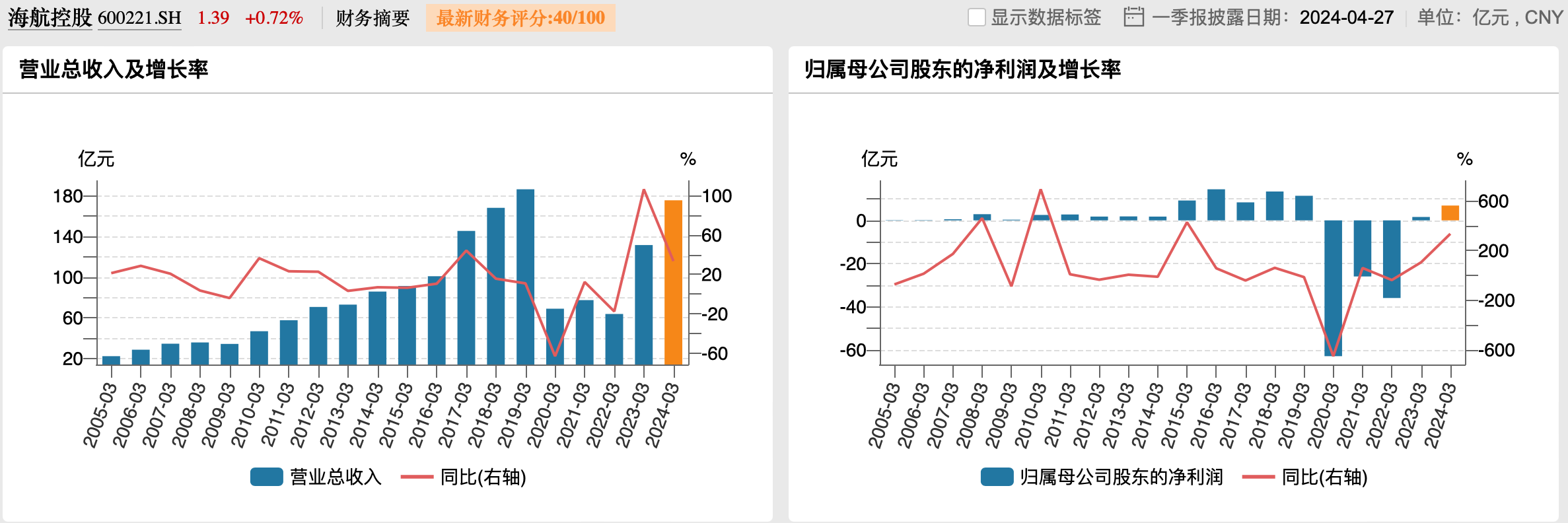

In the first quarter of this year, the revenue was 17.55 billion yuan, a year-on-year increase of 33.48%, and the net profit was 687 million yuan, a year-on-year increase of 334.51%. The financial report pointed out that the growth in the first quarter was mainly due to the recovery of the aviation market, the company's capacity growth, and the increase in transportation turnover.

According to wind data, on the whole, HNA Holdings has continued to double and recover in recent years, but there is still a certain gap between revenue and net profit and before the epidemic.??

In the evening, HNA Holdings also announced that it plans to introduce 25 new 737 series aircraft, 3 A320/A321 series aircraft, and 28 aircraft from 2024 to 2026, all of which will be introduced in the form of operating leases. According to the announcement, the company will continue to introduce narrow-body aircraft with higher fuel efficiency, more advanced technology and stronger profitability to further expand the size of the fleet and enhance the competitiveness of enterprises.

In addition, HNA Holdings also announced that the board of directors reviewed and approved the 2024 annual financing plan, in order to meet the needs of production and operating funds, the company and its consolidated subsidiaries plan to apply for a comprehensive credit line (exposure amount) from financial institutions not exceeding 10 billion yuan, of which HNA Holdings does not exceed 6.4 billion yuan. In order to improve the efficiency of capital use and the level of income, and enhance the ability of financial efficiency, the company and its consolidated subsidiaries plan to apply for a low-risk credit line of no more than 20 billion yuan from financial institutions without exposure according to business needs to pay for operating expenses. Under the circumstance that the total amount of new credit and withdrawals in 2024 does not exceed the overall financing plan, the amount of the 2024 annual financing plan of the Company and its subsidiaries can be adjusted to each other.

As of the close of trading on April 26, HNA Holdings reported 1.39 yuan per share, up 0.72%.

HNA Holdings achieved a turnaround last year and relied on the Hainan Free Trade Port to expand its profits

Compared with the three major central aviation enterprises that have been reducing losses, HNA, as the fourth largest airline in China, took the lead in turning losses into profits last year.

The main business segment benefited from the strong supply and demand growth of the civil aviation market, which further continued the growth momentum. Hainan Airlines said that the civil aviation market has recovered significantly, the company has expanded its capacity, optimized its route layout, and launched market-competitive aviation products such as "boutique express lines", and the company's production and operation data has increased significantly compared with the same period last year.

Among them, the rapid recovery of HNA Holdings' international routes may be an important factor in its performance to turn losses into profits. Last year, HNA Holdings carried 1.27 million passengers through international routes, a year-on-year increase of nearly 13 times.

In terms of the performance of the major shareholding companies, only HNA Aviation Technology achieved profitability last year. In terms of revenue, Yunnan Lucky Airlines had the highest revenue of 7.393 billion yuan last year. followed by Xinhua Aviation Group, with a revenue of 5 billion yuan.?

It is worth noting that HNA Holdings mentioned in the financial report that in the future, with the construction of the Hainan Free Trade Port, the company will take advantage of the relevant policies of the fifth and seventh navigation rights of the Hainan Free Trade Port to actively explore the international routes of the free trade port, and at the same time give full play to the advantages of the main base airlines, provide maintenance, ground support and other supporting services for global airlines that stop in the free trade port, and expand the company's profit points.

In the non-main business segment, the financial report also pointed out three reasons for the significant change in profits, first, the recognition of debt restructuring gains of 156 million yuan. Secondly, the credit impairment loss was recognized as 159 million yuan. In addition, a fair value change gain of $261 million was recognized.

On the other hand, it also reflects the improvement brought about by the new HNA series of measures after the reorganization. HNA Holdings said that the company overcame the impact of unfavorable factors such as exchange rate fluctuations and high oil prices, and on the basis of ensuring safety and service quality, it continued to implement refined management and continuously improve the level of cost control, and achieved a total of about 3.6 billion yuan in cost reduction and efficiency last year.

From December 8, 2021, the actual control of the operation and management of the main aviation business of HNA Group was officially transferred to Liaoning Fangda Group, a strategic investor. 2023 is the second full fiscal year for Liaoning Fangda Group to become the owner of HNA Holdings, and it is also the "consolidation year" of New Hainan Airlines.

Fang Wei, chairman of the board of directors of Liaoning Fangda Group, introduced at the special meeting of HNA Aviation on January 20 that all sectors of Fangda Group will be profitable in 2023, and the aviation sector as a whole will be slightly profitable, "Affected by factors such as the increasing downward pressure on the world economy and international exchange rate fluctuations, it is not easy to make operating profits", "Profit in 2023 is due to the market after the epidemic, and there are more reasons for everyone's efforts".

This year, it is planned to increase the expansion of short-haul routes in neighboring countries and accelerate the resumption of routes to North America

Last year, HNA Holdings carried 1.27 million passengers through international routes, a year-on-year increase of nearly 13 times. In the first quarter of this year, international passenger traffic increased by more than 2.5 times year-on-year, and Hainan Airlines said that it continued to focus on international routes.

For the development strategy in 2024, in terms of international routes, HNA Holdings also emphasized in its financial report that it will increase the expansion of short-haul routes in neighboring countries such as Japan, South Korea, and Southeast Asia. Improve the construction of Hainan's regional gateway network, accelerate the resumption of regular international passenger routes, especially those involving the "Belt and Road" and RCEP countries, and accelerate the resumption of routes in North America. Combined with the opening of Hainan port and market conditions and the requirements of Hainan civil aviation development strategy, we will strengthen the development and layout of routes for countries along the "Belt and Road" and emerging markets; at the same time, according to the needs of international students, embassies and other tourists, formulate differentiated policies, enrich product diversity, and promote the resumption of international economic and trade exchanges and passenger travel.

At the same time, HNA Holdings also pointed out that it will improve its international operation capabilities, establish a coordination mechanism for international diversion support resources, and set up a support resource base for overseas destinations step by step to improve the recovery efficiency of international flight diversion and landing.

It is reported that at present, Hainan Airlines operates only 3 direct flights between China and the United States per week (1 round trip is counted as 1 flight, the same below), and it will increase to 4 flights from May 16.

On February 26, local time, the U.S. Department of Transportation issued a new notice, saying that from March 31, 2024, Chinese airlines will be allowed to operate a total of 50 regular direct passenger flights between China and the United States per week. Among them, the Chinese airlines involved are still Air China, Capital Airlines, China Eastern Airlines, China Southern Airlines, Hainan Airlines, Sichuan Airlines and Xiamen Airlines. If U.S. airlines reciprocate additional flights, it is expected that the number of flights between China and the United States will increase to 100 per week. In the notice, the U.S. Department of Transportation noted that the current actions are an important step towards further normalization of the U.S.-China market as the 2024 summer and fall season approaches, and looks forward to continuing dialogue with the Civil Aviation Administration of China to further implement the roadmap.

Looking forward to the second quarter of this year, the China Aviation Association analysis said that under the role of air and tourism integration to promote development, the "May Day" holiday will have a good pull on the transportation market, and the market is generally expected to air passenger traffic in the second quarter is significantly higher than the same period last year. HNA Holdings said that during the May Day period, it will increase the investment of wide-body capacity in popular areas to further meet market demand. In the future, HNA Holdings will continue to expand its global route network and continue to restore profitability.